“Buy dividend aristocrats,” shouted the financial preacher from his high pulpit.

“So be it,” we replied and set off in search of the right fund. Why? Because I have lacked a compact list so far. First we look at the regions and finally you will find a complete list of the dividend aristocrats.

Inhalt

One more reminder of what aristocrats are:

- Dividend increase over 25 years

- There is even an index: S&P 500 Dividend Aristocrats. The recording criteria are even more rigorous. 25 years an ever higher dividend is not enough. Just as an indication, we don’t want to get bogged down in the admission criteria here.

- Increase of the dividend over 10 years.

- Dividend payment within the last 10 years.

- Dividend yield 3%.

- In addition, there are criteria for the equity ratio and the gearing ratio.

Dividend Aristocrats Worldwide as ETF

If you want to invest in an aristocrat ETF worldwide, you can take a look at this fund:

SPDR S&P Global Dividend Aristocrats UCITS ETF

ISIN IE00B9CQXS71, WKN A1T8GD

Total cost ratio (TER): 0.45% p.a.

Replication: Optimized sampling

Domicile: Ireland

Distribution: Quarterly

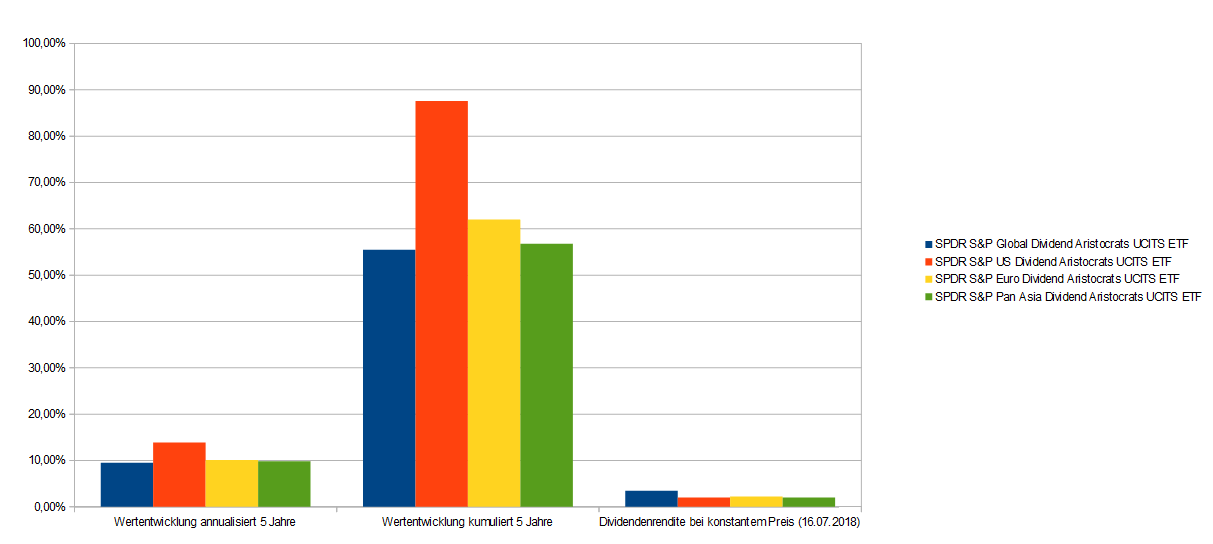

This ETF provides us with a global basket of 100 securities that have not reduced the dividend for at least 10 years. But what does “worldwide” mean? Canada and the USA fill up the ETF with a share of just under 40%. The annualised performance is 9.53% (comparison: iShares MSCI World: 12.36%), cumulated 55.47% (iShares: 74.17%). The dividend yield was 3.46% in one year, if the price remained constant at €29.17 for one year.

US Dividend Aristocrats ETF

You are looking for a US Aristocrat ETF? Here it is:

SPDR S&P US Dividend Aristocrats UCITS ETF

ISIN IE00B6YX5D40, WKN A1JKS0

Total cost ratio (TER): 0.35% p.a.

Replication: Physical / Complete

Domicile: Ireland

Distribution: Quarterly

The fund tracks the S&P High Yield Dividend Aristocrats Index. Development? Annualised in 5 years: 13.91%, cumulated: 87.59%. The dividend yield currently stands at just under 2% with the current price of €44.62 unchanged.

European Dividend Aristocrats as ETF

SPDR S&P Euro Dividend Aristocrats UCITS ETF

ISIN IE00B5M1WJ87, WKN A1JT1B

Total cost ratio (TER): 0.30% p.a.

Replication: Physical (Complete)

Domicile: Ireland

Distribution: Half-yearly

A dividend-paying aristocrat ETF for the Eurozone. The local European is delighted. The index includes 40 companies with a high dividend yield and no dividend reduction for at least 10 years. The performance over 5 years is annualised at 10.12% and cumulated at 62.02%. France and Germany are included with a share of >50% (29.53% and 23.67% respectively). Dividend yield? At 24€ it is 2.25%.

Pacific and Asia Dividend Aristocrats ETF

SPDR S&P Pan Asia Dividend Aristocrats UCITS ETF

ISIN IE00B9KNR336, WKN A1T8GC

Total cost ratio (TER): 0.55% p.a.

Replication: Optimized sampling

Domicile: Ireland

Distribution: Half-yearly

As the name suggests, the Pan Asia ETF invests in companies from the Asia-Pacific region. The companies involved have increased their dividends for at least seven years. Performance: Annualised over 5 years: 9.85% and cumulated 56.77%. The most important countries are Australia and Japan, but China is also interesting with 13%. Dividend yield at a constant price of €40.54 = just under 2%.

Gesamt: Die ETF Dividenden Aristokraten Liste

Das ist die Konklusio. Hier ist die gesamte Liste:

| ETF | SPDR S&P Global Dividend Aristocrats UCITS ETF | SPDR S&P US Dividend Aristocrats UCITS ETF | SPDR S&P Euro Dividend Aristocrats UCITS ETF | SPDR S&P Pan Asia Dividend Aristocrats UCITS ETF |

| ISIN | IE00B9CQXS71 | IE00B6YX5D40 | IE00B5M1WJ87 | IE00B9KNR336 |

| WKN | A1T8GD | A1JKS0 | A1JT1B | A1T8GC |

| TER | 0,45% p.a. | 0,35% p.a. | 0,30% p.a. | 0,55% p.a. |

| Replication | Optimized Sampling | Physical / Complete | Physical / Complete | Optimized Sampling |

| Domicile | Ireland | Ireland | Ireland | Ireland |

| Payout | Quarterly | Quarterly | Half-yearly | Half-yearly |

| Most important countries in the index | Canada and USA 40% | USA 😉 | Germany and France >50% | Australia, Japan and China about 68% |

| Annualised performance 5 years | 9,53% | 13,91% | 10,12% | 9,85% |

| Cumulative performance 5 years | 55,47% | 87,59% | 62,02% | 56,77% |

| Dividend yield at constant price (16.07.2018) | 3,46% | 2,00% | 2,25% | 2,00% |

dividend aristocrats etfs – a graphic comparison (annualised performance 5y, cumulative 5y, dividend payout)

Were those really all ETFs? Ok, well, I kept one from you. There is also the SPDR S&P UK Dividend Aristocrats UCITS ETF which invests in British companies. In my opinion this is very specific and therefore not on the list.

Why are dividends good for aristocrats and ETFs?

- Dividend growth is considered a “quality factor” and shows how consistently a company has paid out dividends in the past. This is not only an advantage (security), but also a weak point (this supposed security – after all, the future is uncertain).

- Companies tend to be more stable

- As an ETF you achieve a nice diversification

- I think aristocrats are nice because they seem “safe”. However, a higher dividend yield can easily be achieved with other securities. Of course, continuity also counts, although I don’t apply such hard criteria as 25 years of growth. It depends on what goal you are pursuing.