First of all I would like to apologize for the somewhat lurid title, but during the brainstorming this right and at the same time wrong, but very beautiful sounding alliteration sounded like music to my ears. Nevertheless, it is still possible to build up a regular income stream with monthly dividends.

Dividends are paid semi-annually, quarterly and even monthly. And because we like dividends, we look at stocks with a monthly dividend payment. But not just any, but also the ones that are in my portfolio.

You have just little time for the whole article? At the end you will find a summary (TL;DR).

Inhalt

Monthly dividend payers – which ones are there?

It’s hard to believe, but there are lots of shares that pay out a monthly dividend. Here is a presentation of which companies, among others, come into question.

Monthly dividend payer list:

- AGNC Investment (AGNC)

- Apple Hospitality REIT (APLE)

- Capitala Finance Corporation (CPTA)

- Chatham Lodging (CLDT)

- Chorus Aviation (CHR.TO)

- Corus Entertainment (CJREF)

- Crius Energy Trust (CRIUF)

- Cross Timbers Royalty Trust (CRT)

- Dream Global REIT (DRG.UN.TO)

- Dream Industrial REIT (DIR.UN.TO)

- Dream Office REIT (D.UN.TO)

- EPR Properties (EPR)

- Enerplus (ERF)

- Gladstone Investment Corporation (GAIN)

- Gladstone Capital Corporation (GLAD)

- Gladstone Commercial Corporation (GOOD)

- Global Net Lease (GNL)

- Granite Real Estate Investment Trust (GRP)

- Harvest Capital Credit Corporation (HCAP)

- Horizon Technology Finance (HRZN)

- Hugoton Royalty Trust (HGT)

- Inter Pipeline (IPL.TO)

- Gladstone Land Corporation (LAND)

- LTC Properties (LTC)

- Main Street Capital (MAIN)

- Orchid Island Capital (ORC)

- Realty Income (O)

I also don’t want to hide where this compressed list comes from. On suredividend you will not only find the complete list, but also the key figures with a download of the Excel file.

Another source for research is dividend.com. With the Screener you can search for the right stocks and filter the results by different ratios.

The following stocks are in my custody account and are distributed monthly. This is not an investment recommendation, but a securities account statement.

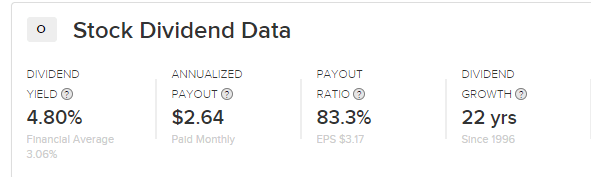

Realty Inc.

Realty is known to almost every dividend investor. Alone because they call themselves “The Monthly Dividend Company”. The special feature of the company: It is a REIT (Real Estate Investment Trust).

I chose the company because …well…I was hungry for a monthly dividend and Realty convinced me.

The dividend growth speaks for itself. 22 years of dividend increases are impressive. Realty Income’s portfolio also looks very stable. Walgreens accounts for 6.7% of turnover as a tenant. The company just mentioned is a pharmacy chain and, in my opinion, is visited by consumers even in bad market phases. Another larger position is FedEx with 5.0%, then it splits relatively evenly and the profit diversifies nicely over many companies, mainly in trading. But this specialisation in trading is the only thing I don’t like very much. Otherwise, I think Realty is a great way to collect dividends on a monthly basis.

Here is an excerpt from Portfolio Performance:

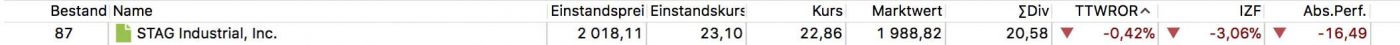

STAG Industrial Inc.

Like Realty, STAG is another REIT that invests mainly in industrial real estate. This is an individual letting, which of course also involves risks. However, caution is also advised before interest rate hikes (even if this topic is sometimes controversially discussed in connection with REITs). I take the risk. From a “dividend perspective”, what are the advantages for the company? An increase in the dividend over seven years and the financial situation. At this point, however, I would like to point out the tax situation, which is not particularly tingly for REITs in my Country. I will write something about this and adjust my portfolio if necessary.

Here is an excerpt from Portfolio Performance:

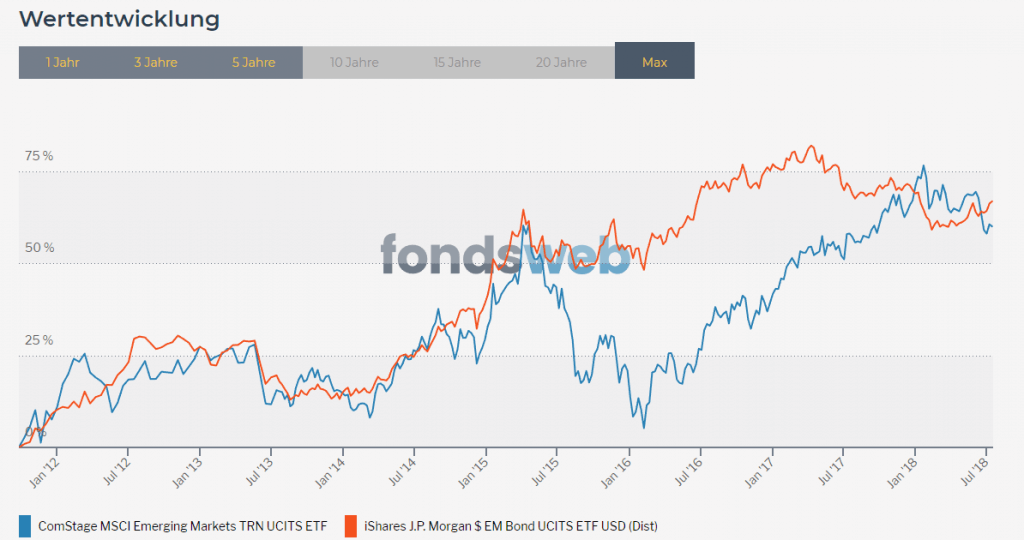

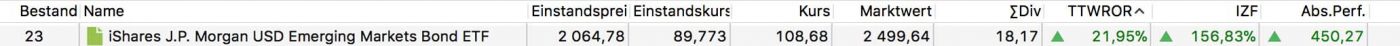

Emerging Markets invests in emerging market government bonds. I have taken the ETF as an addition to the Comstage ETF. At 0.45% TER, it is not the cheapest monthly dividend ETF, but that has already been recouped. What I like about the ETF is that it has, for example, cushioned the fall in prices in 2015, diversified across many countries and, of course, paid out the monthly dividend. In short: I cover the opportunities with the equity fund, the risks with the bond fund. You can find the exact dates on JustETF.

Here is an excerpt from Portfolio Performance:

The happy dividend hunt continues

I like the monthly distributions, but at the end of the year it will be decided whether the two REITs will remain in the portfolio. The emerging markets are also doing their bit, and I will continue to do so anyway. However it comes, the dividend hunt will continue.

TL;DR

Indeed, there are, the monthly dividend payers. In the article I have listed some of them, as well as sources that list many more companies and provide more accurate data – suredividend.com and dividend.com. You can also take a look at my 3 monthly dividend payers. These are: Realty, STAG and the iShares Emerging Markets Bond. In addition, you will find a detailed excerpt of portfolio performance for each security.