Death mood on the stock exchange! The media spread a doomsday mood and in relevant Facebook groups nervous users send numerous messages about “selling or holding”. In my opinion, many things are very exaggerated. I completely disregard the economic situation – as we probably all do – but not. Only these shock scenarios are a horror to me. In principle, I am adhering to my long-term strategy. In this article I will discuss the two main factors that are currently weighing on investors and show you how my portfolio has developed in recent months. Simply to get a feel for how I evaluate the current situation in relation to my assets. (Today I’m almost a bit late with the contribution – almost everything green in the portfolio^^)

Why has the stock market gone down in the last few days? Two factors are currently playing a major role:

- The IMF forecast

- The interest rate increases of the FED

In a new report, the IMF has pointed to a more difficult world trade situation if the trade dispute between the US and China continues. As the report flies by, other risks are highlighted, such as the generally very high level of debt, protectionism and rising inequality. The report also shows, however, that growth forecasts do not point to the end of the world, but that growth for advanced economies is likely to fall from 2.4% in 2018 to 2.1% in 2019. Global growth is forecast to remain at the same level in 2019.

However, it is understandable that such a forecast after 2007/2008 would put investors in turmoil. In 2007, the IMF said that the forecast for 2008 was 4.8%. According to the 2009 report, the result was 3.0%. It is interesting to note that the 2007 report already referred to the subprime problem. Why? Because, to my knowledge, the first banks reported losses in 2007. A risk of a recession was also mentioned, but the FED was expected to intervene quickly. Growth was more likely. In 2008 and 2009 the reports already looked different. Of course, the crisis was already one foot in the door. What can we conclude from this? It is almost impossible to predict crises directly in the long term and when they will occur. Because it’s the future, stupid. 😉

Interest rate hikes, on the other hand, have an impact on the stock market, loans become more expensive and investments are dampened. That’s why Trump also insults the FED’s current agitation. After all, protectionists want cheap money for their economy. However, a key rate hike is supposed to keep inflation in check.

I also had losses, but overall I am not in the red with my portfolio. When I look at the postings of some colleagues who really suffered heavy losses, I also understand why people become sceptical. As mentioned above, although I am not completely ignoring the economic situation, I am adhering to my long-term investment strategy. Yesterday I transferred money quickly to profit from the price setback. So much for that.

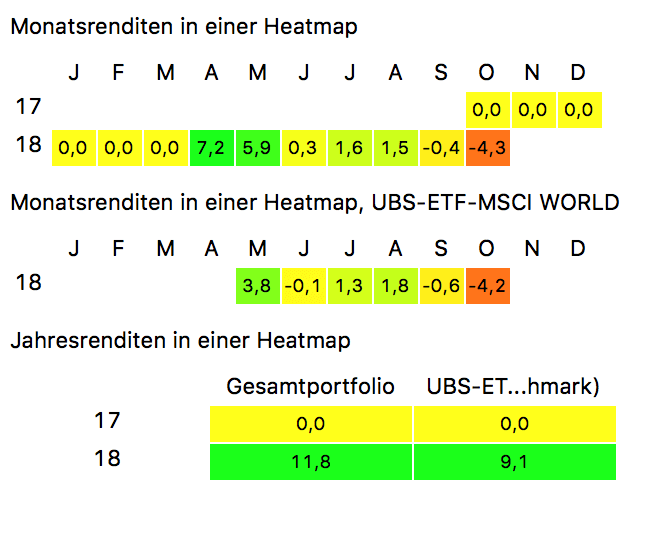

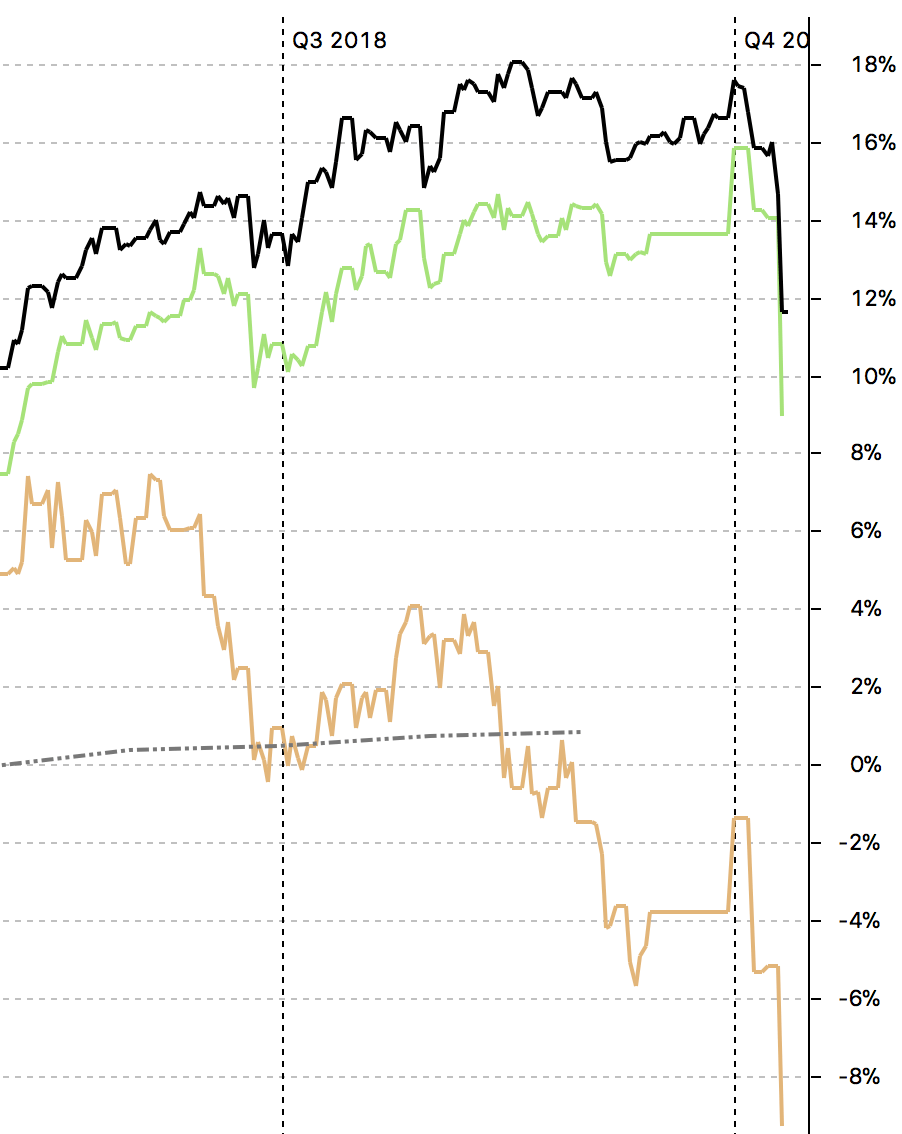

You can see how my portfolio has developed recently from the diagrams. (PP set up in April 18′; monthly returns 1: portfolio; 2: benchmark)

Black line: Portfolio

Green: World Benchmark